Formula One is back. The season opener in Bahrain threw up some major surprises on the track, perhaps foretelling a season of even greater excitement than the last which ended in such controversy in Abu Dhabi last year.

It is now five years since the Liberty Media Corporation acquired Formula One with the intention of accelerating growth through an expanded competition, regulation change and a massive programme of digital engagement. The disruptions of Covid-19 put a spanner in the works and saw disastrous financial results posted in 2020, but Liberty’s ambitions remain high – the season finale in Abu Dhabi posted 29% audience growth over 2020 and a record 23 races were planned for 2022 before the Russian Grand Prix was cancelled.

2021 financial results: a strong rebound

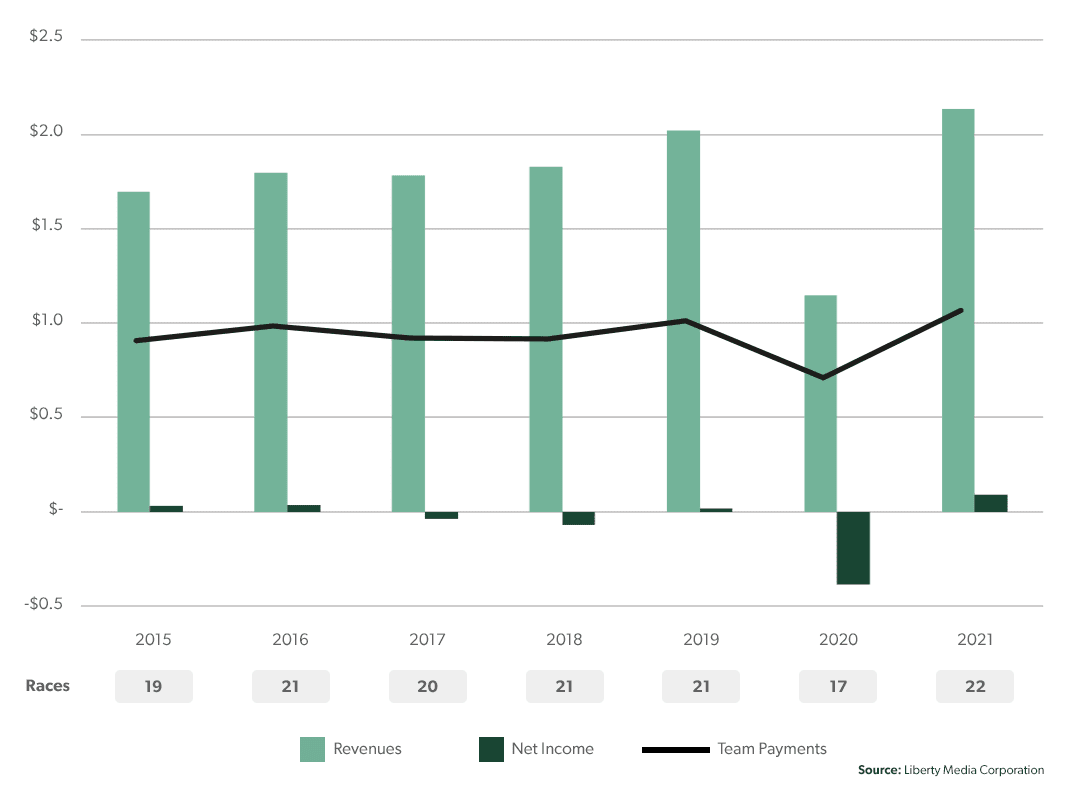

At the end of February, Liberty released headline financials for 2021. The numbers showed an impressive return to revenue growth – at over $2.1bn, up 86.6% over the dismal performance in 2020 when Covid-19 reduced the season to 17 races and slammed the brakes on the top line momentum developing under the new owners. Revenues were also up on the last pre-Covid season: though the 5.6% growth over 2019 did not match the 10.7% year-on-year improvement from 2018 despite an additional race in the calendar. Of course, restrictions were still in place in various jurisdictions meaning that some races were run with caps on attendance (e.g. 4,500 in Bahrain) or with no spectators at all (Italy, Portugal, Azerbaijan).

Team payments also rebounded to just over $1.0bn, a rise of 50.2% on the $711m of 2020 - an increase of $35.7m per team on average. Team payments thus fell to 50.0% of F1 revenues, a standard policy since Liberty’s takeover which was applied in 2018 and 2019, down from an average of 53.2% over the previous three years. 2020 had seen the percentage of revenues allocated to team payments jump to 62.1%.

Liberty declared operating incomes of $92m for 2021, a huge positive swing from the $386m losses of 2020 and the highest incomes posted since the acquisition was completed. Liberty oversaw losses in its first two years in the driving seat, only delivering a modest positive result in 2019 before Covid-19 struck. Net income was more than double that posted in 2015 and 2016 before the takeover and equates to $4.2m per race in 2021. Aside from the return of crowds – see below for details – Liberty also noted increases in broadcast and sponsorship revenues in 2021, as well as a one-off settlement in relation to the cancellation of the Vietnam Grand Prix in 2020.

Formula One has seen solid financial recovery in 2021

Back to the tracks: fans return and a US attendance record

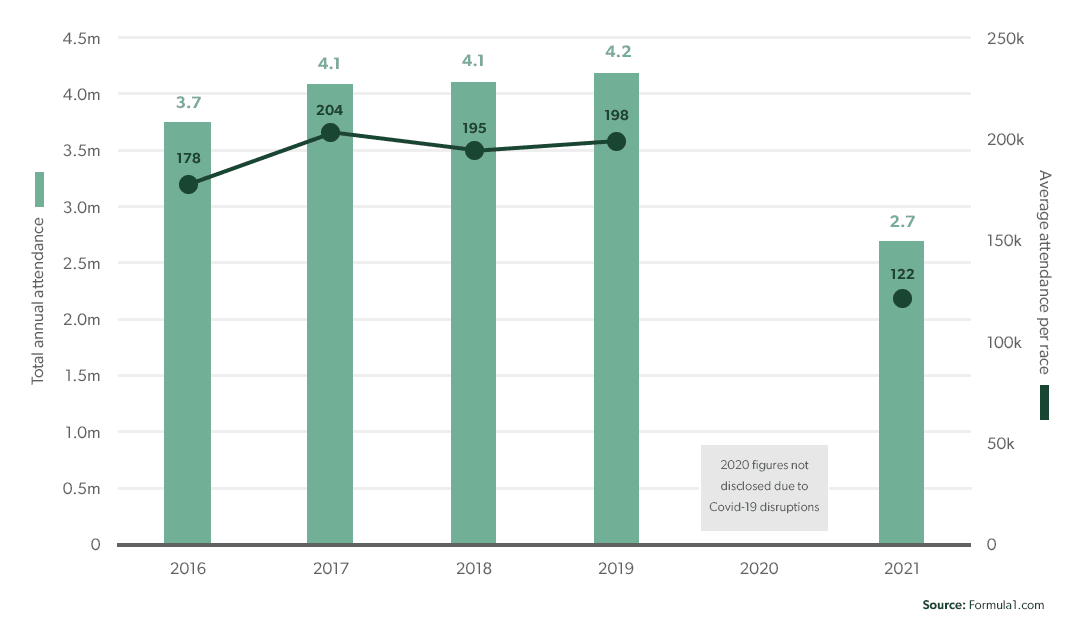

In comments on the results, Liberty Media made it clear that the return of fans was a driving factor in the positive turnaround in 2021: “Fan attendance continued to be assessed by relevant government authorities on a race-by-race basis throughout the year, with restrictions easing as the year progressed and significantly higher fan attendance beginning in the third quarter of 2021 compared to the prior year,” the company said.

In total, just under 2.7 million people are reported to have attended race weekends during the 2021 season, down 35.4% on 2019’s total of 4.2 million. On a per-race basis the figure was 122.3k, down 38.3%. More positive news was the record attendance set in the USA, where an estimated 400k were reported to have attended the race held at Circuit of the Americas in Austin, Texas at the end of October, a 49.2% increase on the 2019 estimate of 268k. This smashed the top attendance figure of 2019, the 351k set at Silverstone for the British Grand Prix, and according to wtf1.com has only been bettered twice in history – by the Australian Grand Prix races of 1995 and 1996, both of which were held over four days rather than three.

Race weekend attendances saw partial recovery in 2021

Drive to Survive: a key driver?

A lot has been written about the impact of the Netflix series Drive to Survive on the global popularity of Formula One. The documentary has been credited with enlivening the F1 championship in countries around the world, in particular in the United States – as noted in The Guardian, “More than 400,000 turned up for this year’s US Grand Prix. One million more watched the race on TV. Overall ratings for this season are up more than 40%, making this the most-watched F1 season in America. And it’s not just the US – the sport added an estimated 73 million fans last year, in markets including Brazil, China and France.”

Unlocking the massive potential of US audiences is certainly one of Liberty’s major objectives, and the addition of a second American race to the 2022 schedule (based on the streets of Miami, the first time the US has hosted two races since 1984) is a choice clearly in service of this aim. But to what extent is the sport’s increased global popularity visible in the data?

Looking first at social media, it is fair to say that the number of Formula One fans online is growing rapidly. From a starting point of 7.8m social media followers when Liberty took over at the end of 2016, that number has reached 49.1m at the end of 2021, an annualised growth of 44.5%. Chinese social media channels and Snapchat, Tiktok and Twitch were added to the reported numbers from 2019 and will have contributed to the accelerating growth, which saw 14m followers added in 2021 alone.

A similar story is visible in users of the official Formula One website and F1 App, which have been reported since 2018. 48m unique visitors were reported in 2018, rising to 113m in 2021 – a CAGR of 33.0%. Also reported were page views rising from 617m to 1.6bn in the same period – annual growth of 36.2%. It is not possible to determine the extent to which Drive to Survive has contributed to the growth but it is highly likely to have played a role. Netflix is very cagey with its viewing figures but the level of hype surrounding the show – it trended number one globally after launch of the third series and a fourth series dropped this month – indicate that it has been a major success.

F1 social media growth started before Drive to Survive\n

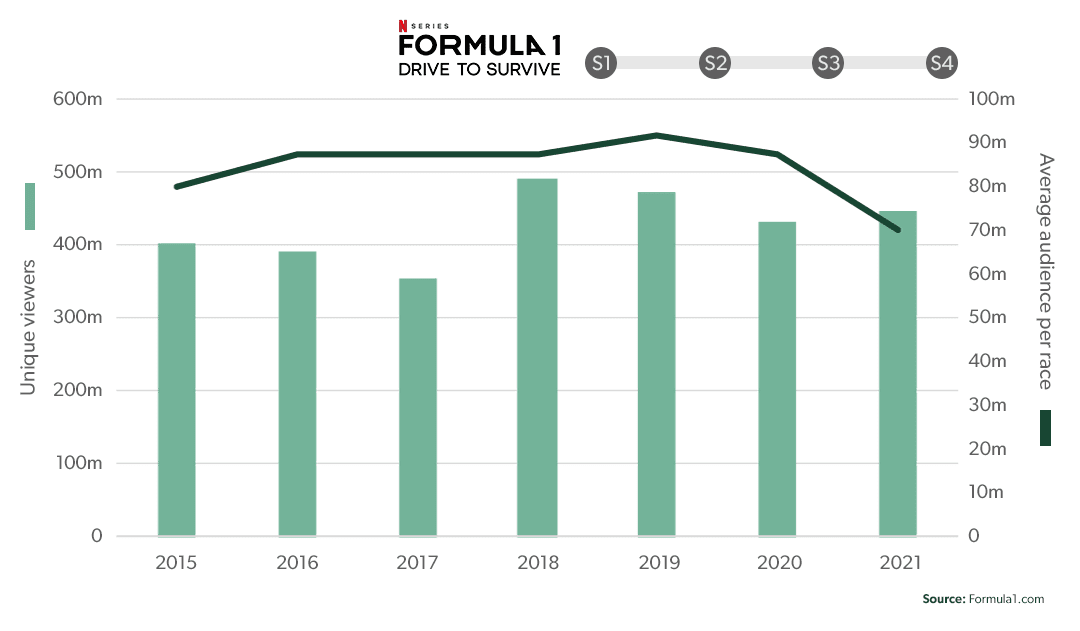

Turning to the viewership of races, the numbers tell a different story. While the number of unique viewers has grown in 2021, up from 433m to 445m, a 2.7% increase might have been disappointing to those expecting a big jump on the back of five additional races in the calendar and the return of the US Grand Prix. Indeed, since a major jump in viewership to 490m in 2018 appeared to halt a downward trend which had lasted the best part of a decade (600m is the official number for 2008 unique viewers), viewership has been slipping again – an average decline of 6.0% over the two years from 2018 to 2020. Perhaps even more concerning is the fall in average viewership per Grand Prix to 70.3m in 2021, which represents a fall of 23.2% on the 2019 number of 91.5m.

Liberty have undoubtedly done a very good job of engaging new and younger audiences around the world with Formula 1 – even before Drive to Survive premiered in 2019 they started developing digital engagement through the launch of eSports tournaments, F1 Fantasy, a dedicated F1 TV channel and the Beyond the Grid podcast, as well as investing in a strong and cohesive social media strategy to underpin these offerings. But Drive to Survive focuses on the characters behind the scenes of the race, while providing bitesize pieces of racing action for those who want to know the narrative of the season and see the peak moments without committing to watching the full races.

Increased popularity of F1 does not appear to translate into viewership of races