A great deal has been written in the media over the past few years about player decisions to move to the North American or Chinese soccer/football leagues. But as these leagues mature and become more established, there is evidence such moves are in decline.

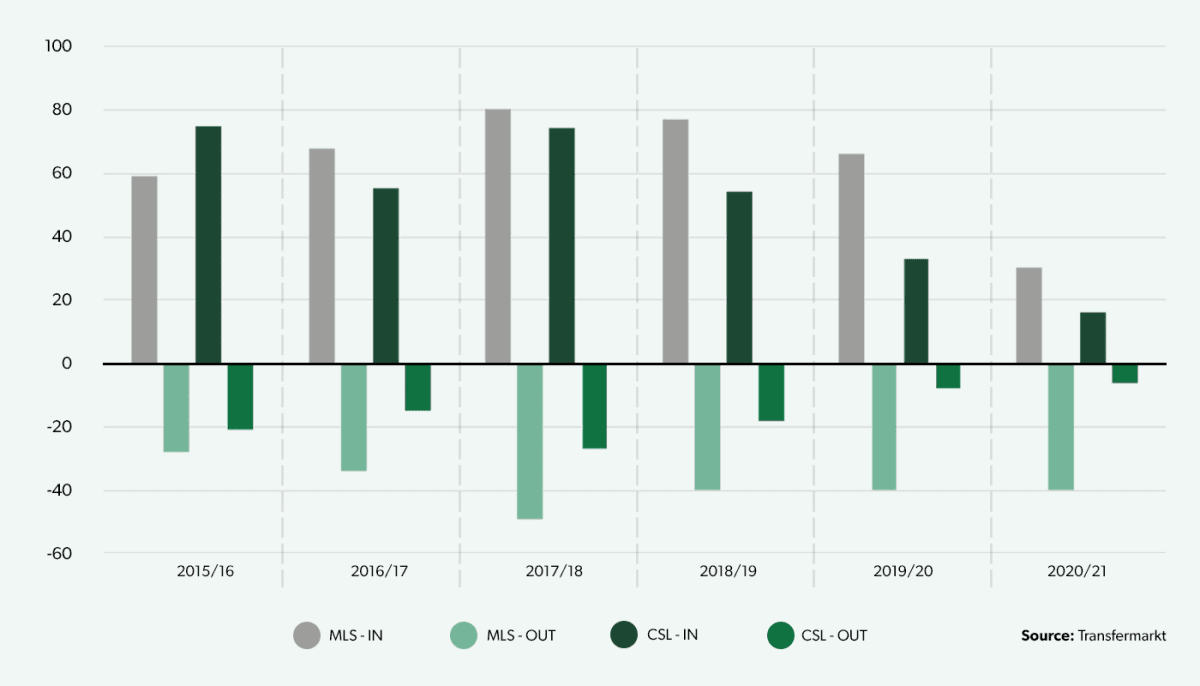

Overall, there has been a pronounced decline in the number of player transfers between European clubs and both Major League Soccer (MLS) and the Chinese Super League (CSL).

- The number of players coming from European clubs to the MLS peaked at 80 and 77 in 2017/18 and the following year, but fell dramatically in the past two (European) seasons.

- In 2020/21, MLS clubs collectively became net exporters of players to Europe, as 40 players were traded out vs. 30 players arriving.

- In the CLS, the peak years were in 2015/16 and 2017/18, since when numbers have fallen even more dramatically, to just 16 players in 2020/21 – driven by the introduction of strict new caps on international player salaries.

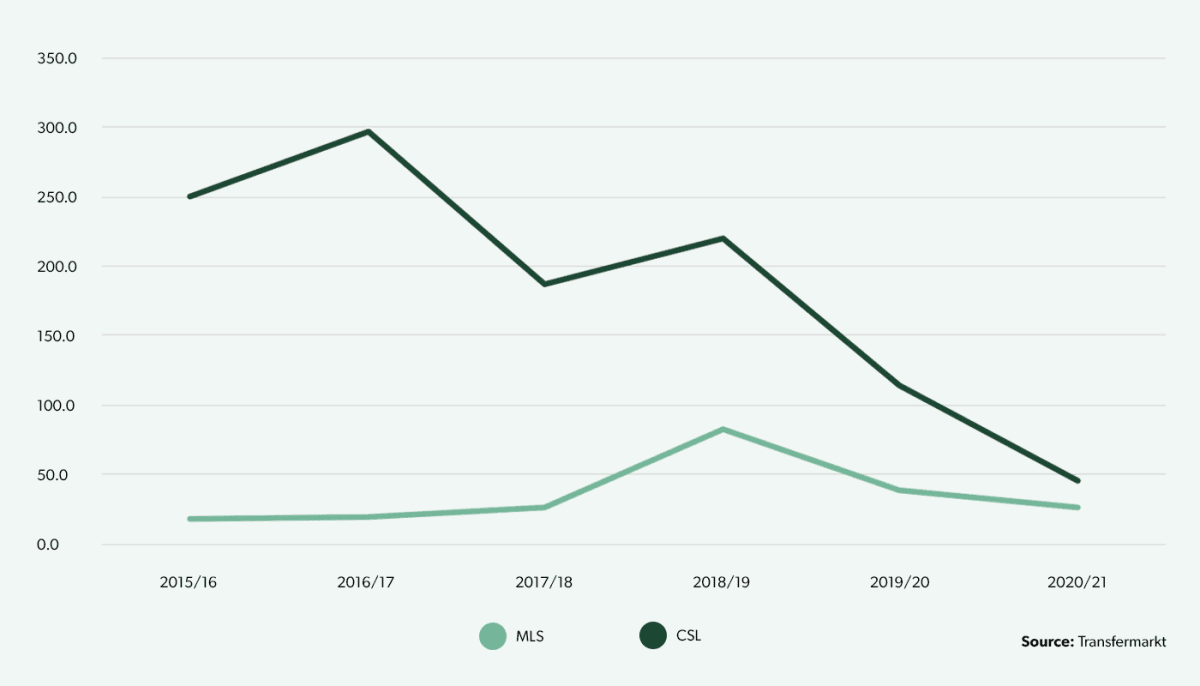

The sums involved in player trading between the MLS and Europe have been significantly lower than in the CSL, during the period studied.

- For the MLS, the peak in player trading occurred in 2018/19 when €82.7m changed hands with European clubs over the two transfer windows – but this number fell to €26.0m in the latest season.

- The player trading market between European clubs and Chinese clubs peaked in 2016/17 at €297.4m – more than 15 times the equivalent sum for the MLS in that season.

- The total sum of player trades between Europe and both the MLS and CSL was €70.9m in 2020/21, down 54% from the previous year and 78% from the peak in 2016/17.

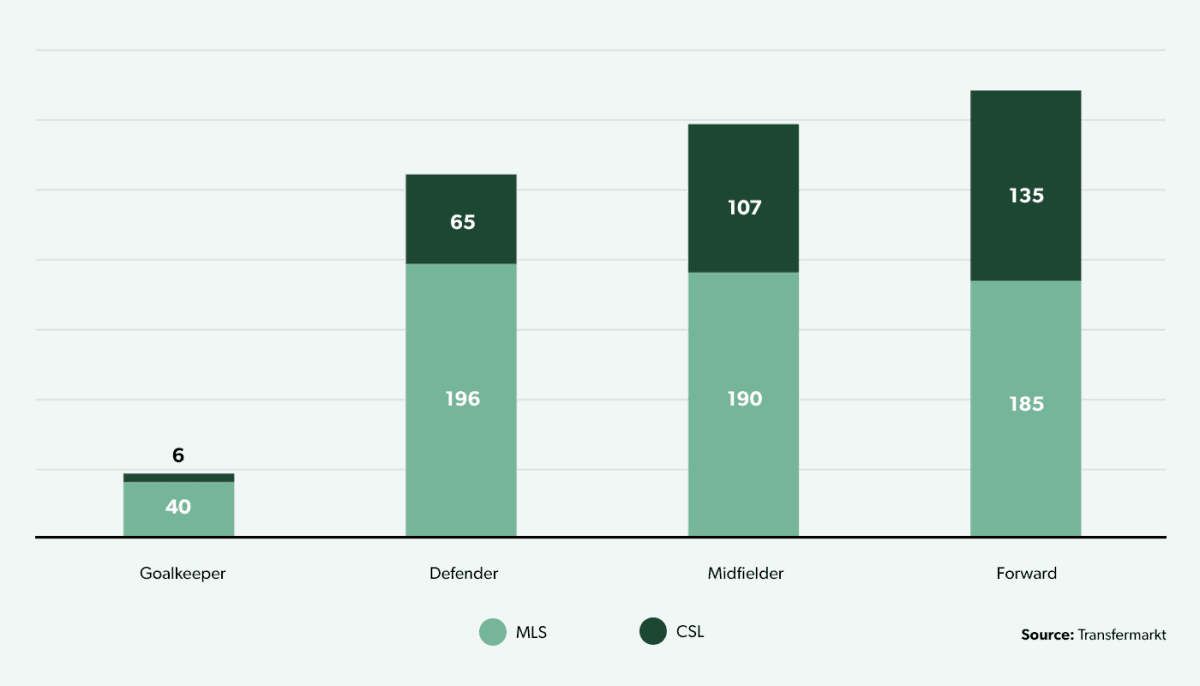

The MLS has taken a balanced approach to positional recruitment from Europe, while the CSL focused on attacking players.

- Across the 6-year period, MLS clubs recruited a similar number of defenders, midfielders and forwards from European clubs, and 40 goalkeepers made the move.

- Meanwhile in the Chinese Super League, 43% of players brought in from Europe were forwards, 34% midfielders and only 23% defenders or goalkeepers.

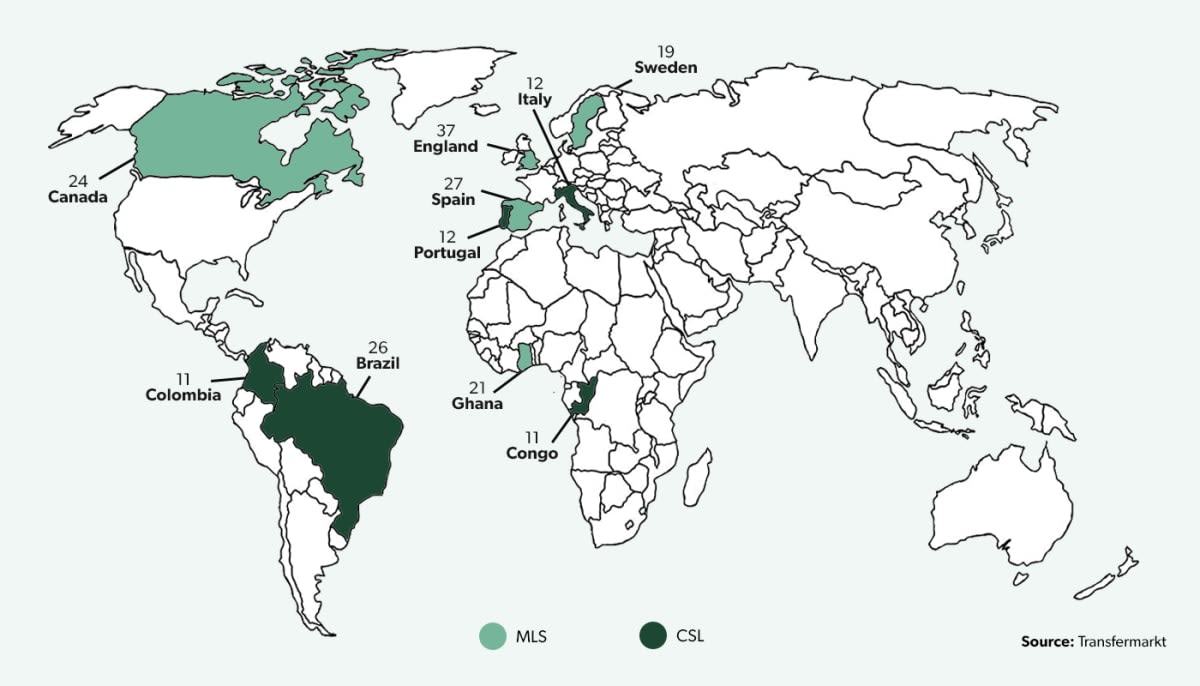

Top nationalities of players arriving in the MLS from Europe have been predominantly European, while many Latin American players made the move to China.

- In the years 2015/16 to 2020/21, the most common nationality of player moving from European clubs to the MLS was English (37 players). There were also 27 Spanish and 19 Swedish players.

- The most common nationality for players moving to the Chinese Super League was Brazilian, and Colombian also features in the top five.

- Portuguese players – speaking the same language as those from Brazil – and Italians are the top European nations represented amongst transfers into the CSL.

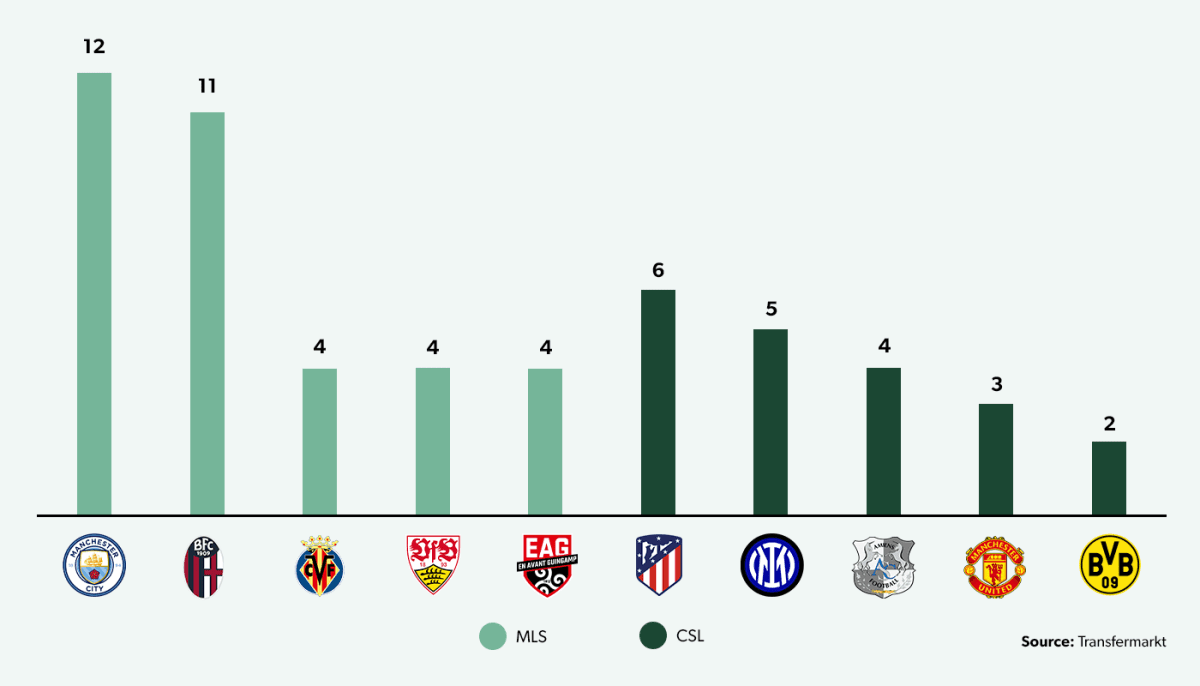

Most transfers take place between clubs with previously-established links with clubs in North America and China.

- The English club making the highest number of player trades with the MLS was Manchester City, with its sister club New York City being involved in 7 of its 12 transfers.

- Similarly, 10 of the 11 transfers between Bologna FC and the MLS were with Montreal Impact, its sister club under the ownership of Joey Saputo.

- The clubs in Spain and Italy making the most player trades with Chinese clubs were Atletico Madrid, which was part-owned by Chinese conglomerate Dalian Wanda Group between March 2015 and February 2018, and Inter Milan, majority-owned by Suning since June 2016.