With over 13.5m reported cases, India has overtaken Brazil to move into second place in the global table of countries with the highest number of Covid-19 cases, in the week it launches its most prestigious annual sports competition.

The International Cricket Council is reportedly viewing the IPL tournament as a dry run ahead of the men’s T20 World Cup, scheduled to take place in October and November 2021, which was postponed from 2020 and moved to India from Australia.

While the Indian Premier League was founded in 2007 and its inaugural season played in 2008, cricket has been played in India for approximately 300 years, having been introduced by the British during the expansion of the East India Company from the 17th to the 19th Century. The game was adopted by the Indian elites who formed alliances with the British, with Indians playing against British teams and ultimately forming leagues between local teams. The first definite reference to cricket being played anywhere in the sub-continent is a report of a match at Cambay, near Baroda in 1721. The Calcutta Cricket and Football Club was founded sometime between 1780 and 1792 and this club’s match against Madras in 1864 has been suggested as the start of first-class cricket in the country.

Short formats are growing in popularity but the development of the T20 format by the England & Wales Cricket Board in 2003 has arguably had the most transformative impact in any sport. The format was rapidly adopted around the world and formal leagues have been launched in Australia, India, Bangladesh, Pakistan, South Africa, Afghanistan and the Caribbean, accelerated by the popularity of the inaugural T20 World Cup in 2007.

The IPL has eight franchises. The original franchises were auctioned in January 2008 for a combined value of more than $720m, of which only the Deccan Chargers have dropped from the IPL after failing to find new owners in 2012 and being replaced by the Sunrisers Hyderabad from 2013. Franchises were also launched in Kochi and Pune in 2011 but were terminated after one and three seasons respectively after disputes with the Board of Control for Cricket in India (BCCI). In 2015, it was announced that the Chennai Super Kings and Rajasthan Royals would be suspended for two seasons following their role in a match-fixing and betting scandal; they were replaced by Rising Pune Supergiant and the Gujarat Lions for two seasons. The BCCI has announced it is planning to add two more teams on a permanent basis from 2022.

Each club plays the other seven at home and away before playoffs decide the winner between the clubs finishing in the top four positions. The entire tournament comprises 60 matches and in 2021 will be played over a total of seven weeks. Squads must have between 18 and 25 players, with a maximum of eight non-Indian players (only four of whom can appear in a matchday line-up) and a total salary cap of $12.0m. Players are acquired through an annual auction – for which players sign up and set their own base price – and through regular trading windows, generally two before the auction and one afterwards but before the start of the season. Unsold auction players can also sign as replacement signings before or during the tournament. According to a 2015 survey by Sporting Intelligence, the average IPL salary when pro-rated is US$4.3m per year, although players in the IPL are only contracted for the short duration of the tournament.

Competing in popularity with the world’s biggest leagues

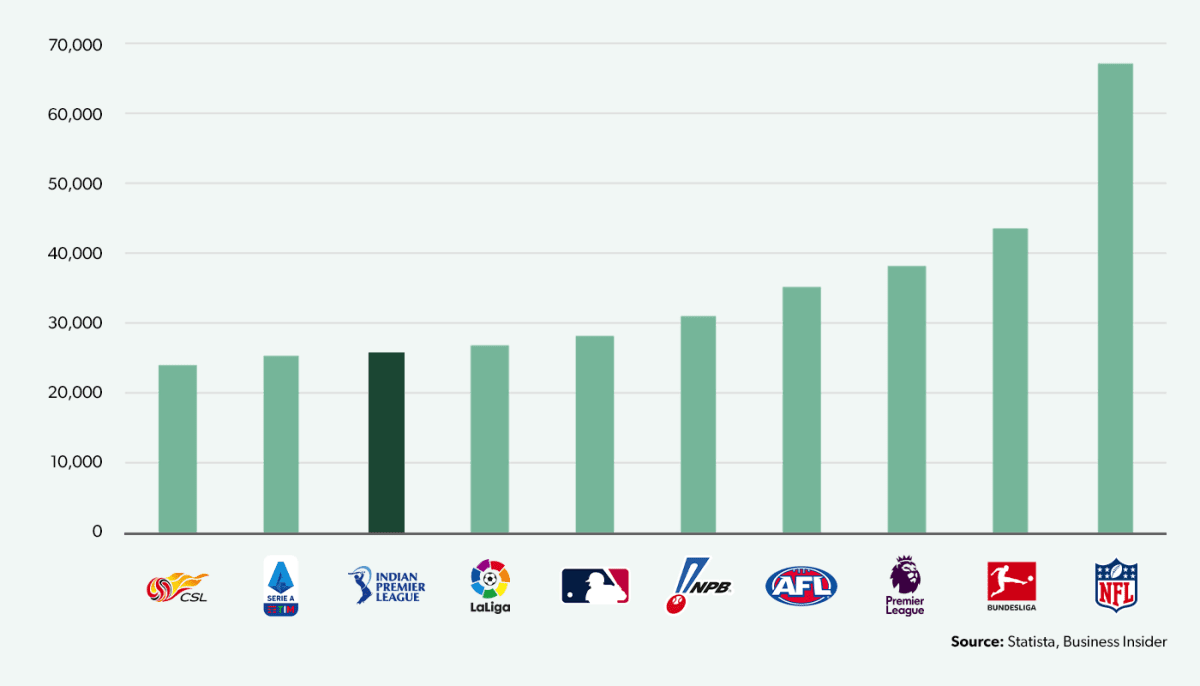

The IPL is the most-attended cricket league and the eighth most-attended sports league in the world, with an average attendance of around 26,000 spectators at each match. This places the tournament ahead of the Serie A and Ligue 1 football competitions in Europe, though with only 60 matches compared to the 380 played in those leagues. There is plenty of room for the IPL to continue growing: the league’s smallest stadium (that of the Punjab Kings) holds 26,000 but the largest (of the Kolkata Knight Riders) holds 80,000 meaning the capacity exists for an average attendance second only to the NFL, at around 44,500.

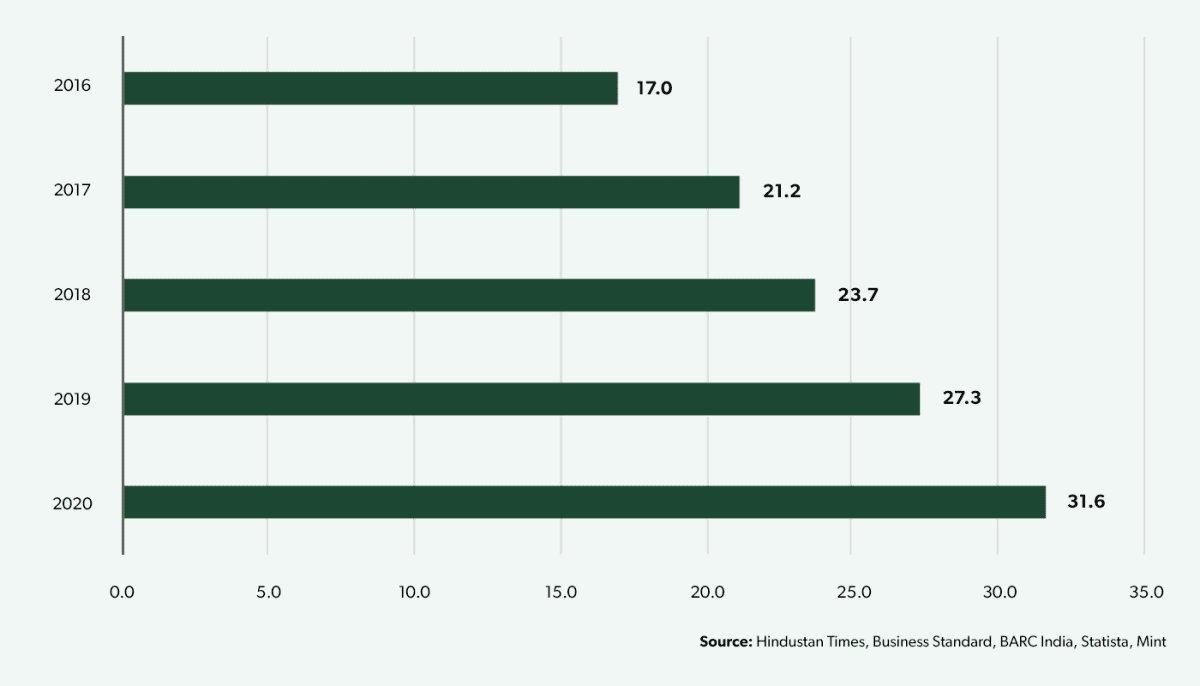

From a TV audience perspective the IPL has seen impressive growth over recent years, from 17.0m in 2016 to 31.6m in 2020, an average growth of 17% over the past four years. In 2020, Covid-19 lockdowns caused the tournament to be delayed from March and eventually postponed indefinitely in India. It ended by being played between September and November 2020 in the United Arab Emirates, which likely contributed to another significant year of TV audience growth as fans in India were unable to attend the matches.

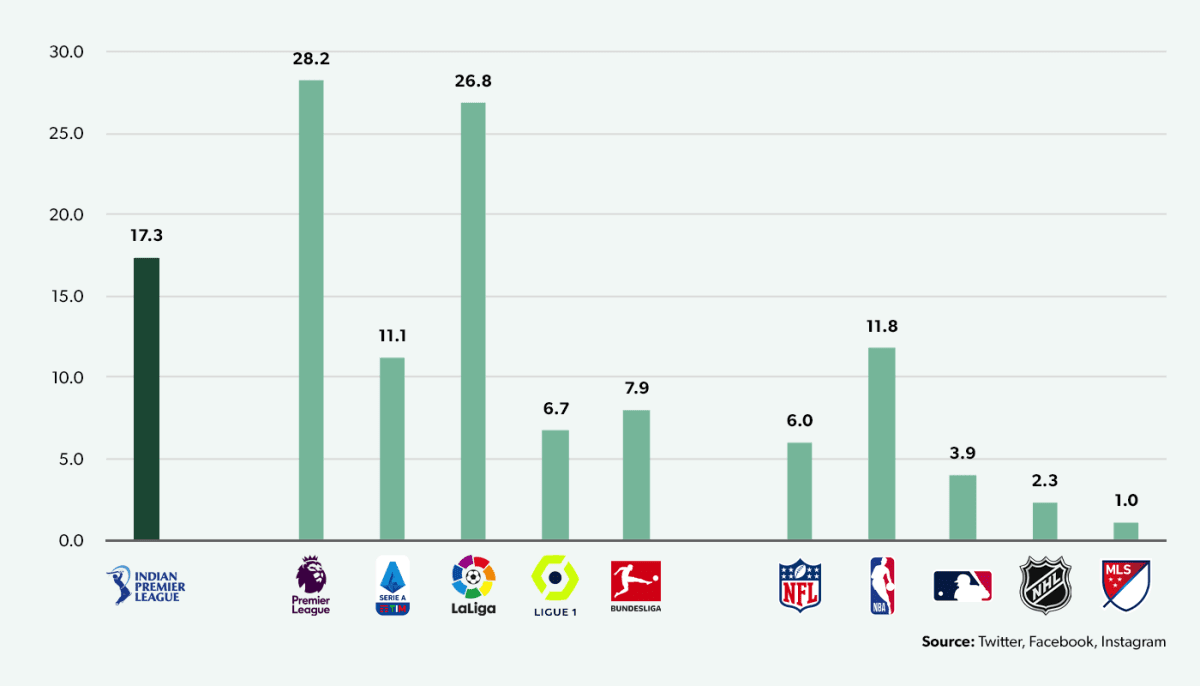

On social media, the average IPL club’s following across Facebook, Twitter and Instagram is higher than in all other major sports leagues except the Premier League and La Liga. The fact that there are 1.4 billion people in India and only eight IPL clubs competing for followers are important factors: the club with the lowest following is the Rajasthan Royals with 7.5m (compared with 1.3m in the Premier League and as few as 160k in Serie A or the MLS). As with match attendances, there is a lot of headroom for growth with the largest social media following – enjoyed by most frequent champions the Mumbai Indians – of just 27m, compared to the 85m in Ligue 1 and the Bundesliga, 103m in Serie A, 138m in the Premier League and 244m in La Liga.

Growth in TV and sponsorship revenues causes jump in IPL value

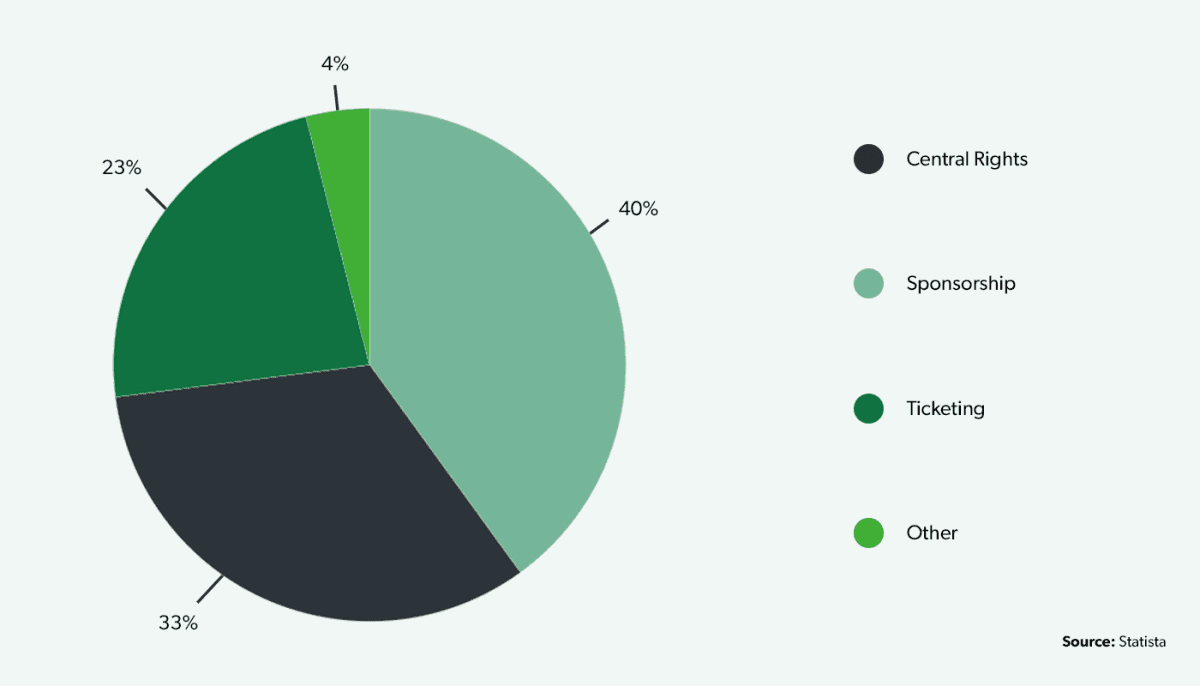

The revenue profile of IPL clubs is not dissimilar to that of European football clubs, with the majority (40%) coming from central rights (league broadcasting revenues and title sponsorship rights), followed by 33% from club sponsorship agreements and 23% from ticketing revenues.

The IPL’s broadcasting revenues took a significant step forward when it was announced that the then-current digital rights-holder, Star India (owned by Disney/ESPN), had acquired the global media rights to the IPL under a 5-year contract beginning in 2018. Valued at $2.55bn, this represented a 158% increase over the previous deal, and the most expensive broadcast rights deal in the history of cricket. The deal has been one of the contributing factors in the rapid growth of the value of the IPL, as the competition is transmitted via regional channels in 8 different languages rather than via networks with English-only commentary as under the previous deal.

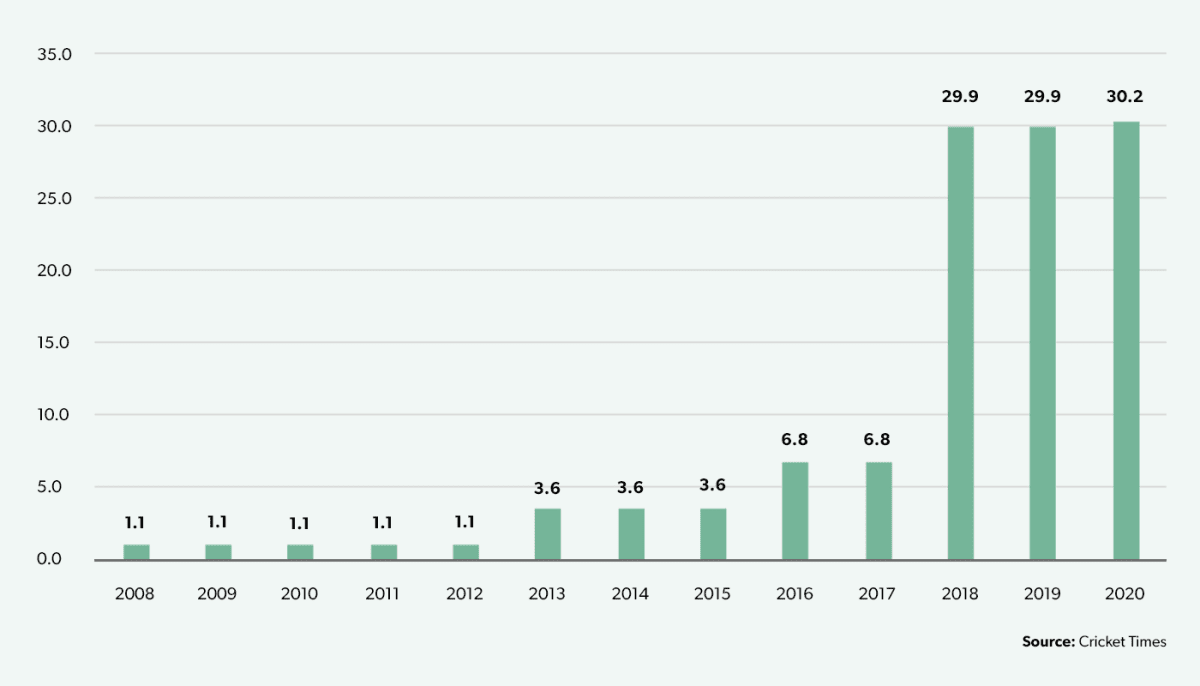

From 2008 to 2012, the title sponsor of the IPL was DLF, India's largest real estate developer, paying $1.1m per season. PepsiCo then bought the rights for five seasons from 2013, but terminated the deal in October 2015 after three, reportedly due to the two-season suspension of Chennai and Rajasthan franchises from the league. The BCCI transferred the title sponsorship rights for the remaining two seasons of the contract to Chinese smartphone manufacturer Vivo, which retained the rights for the next five seasons (2018–2022) in a deal worth more than Barclays's sponsorship of the Premier League between 2013 and 2016. Vivo temporarily withdrew from the deal in 2020 due to political tensions between India and China and financial difficulties as a result of Covid-19 related losses and was replaced by fantasy sports platform Dream11.

Title sponsorship rights have grown nearly 30 times since the inaugural year of the tournament, and in 2020 the contract value is approximately 50% larger than the average in the European Big 5.

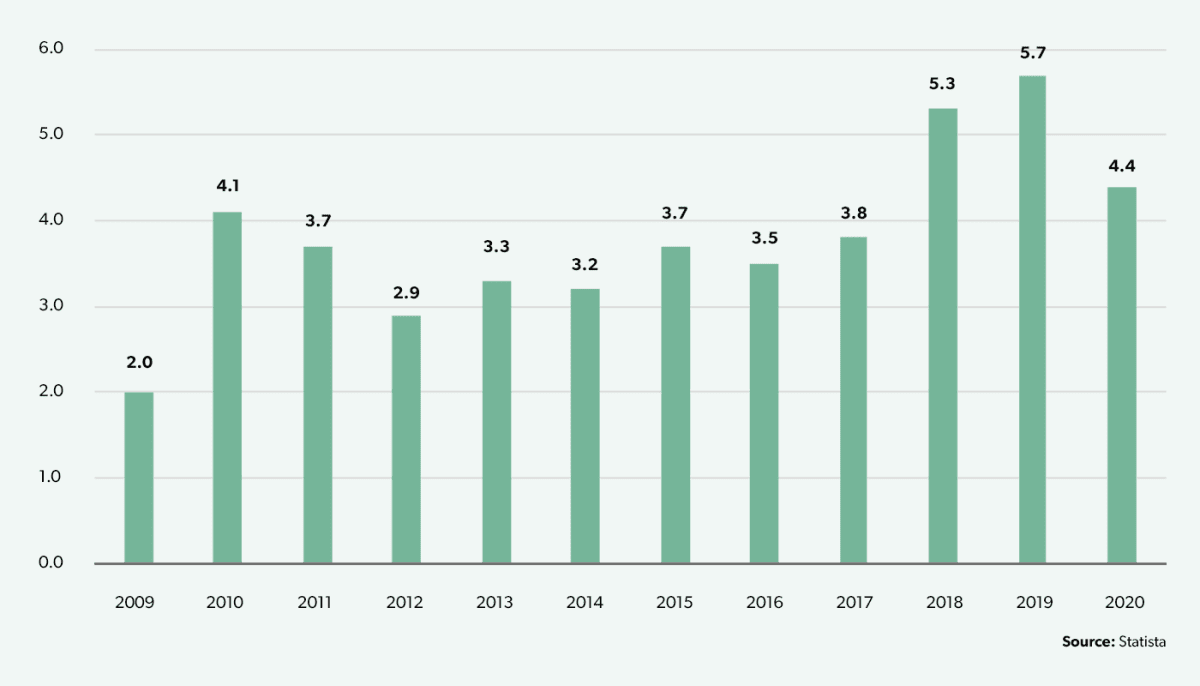

The increase in broadcast and sponsorship revenues since 2018 have contributed directly to a significant shift in the value of the Indian Premier League itself, which jumped by $1.5bn or 40% from $3.8bn in 2017 to $5.3bn in 2018. Prior to this gain the value had been increasing by about $180m per year.